If you’re a first-time home buyer, getting into the real estate world (especially in today’s market!) can be scary and overwhelming!

Check out this list of things to DO and DON’T do to help you get started on the right foot for your first-time home purchase:

DO:

Get Pre-Approved.

Sitting down for the preapproval process means having a professional give a formal analysis of your financial situation. They will collect your proof of income and assets as well as pull your credit. This will find the amount of money you can afford to spend on a home. It’s no use searching for and falling in love with homes that you can’t afford yet.

Plus, you will be given a pre-approval letter to go alongside your (eventual) offer. Proving that you have the money to back that offer puts a lot more assurance behind it and increases your likelihood of getting the deal!

If you’re not sure where to start in getting pre-approved, we recommend working with Andrew Jordan at TowneBank Mortgage. The Thompson Team has had a trusted, professional relationship with him for years and we have worked together many times in helping buyers purchase their dream home!

Meet with a professional Real Estate Agent.

Here’s where we come in! After you get your pre-approval letter, we can start the serious searching. Now that you know how much you can spend on a home, we will sit down with you to discuss the other criteria you are looking for in a new home. How many bedrooms and bathrooms will suit your family’s needs? What style and floorplan do you like? Which neighborhoods do you like?

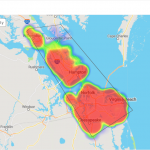

Choosing a team who is ready to work alongside you 24/7 is important. As a full-time real estate professional with 20 years of experience, Eric has built a solid understanding of the Hampton Roads area, the home buying process, and all the emotions you will experience as you encounter the ups and downs of this journey!

Create your Budget.

On top of knowing how much house you can afford, it’s important to plan for the other expenses that you will need to pay when it comes to purchasing a new home. We put together a detailed list of the expenses and how much to expect for each in this blog post below!

Consider the Re-Sale Value.

As your first home, it’s unlikely that it will be your forever home. So, it’s important to consider the re-sale value for when it comes time to make your next move. Building up equity in the first home can help you afford a better/bigger home when you’re ready.

Things to consider for re-sale value include: location (school area, distance to a downtown-type attraction, any future developments, ect) as well as the timeless aspects of the home future buyers will always be interested in (three bedrooms, two bathrooms, walk-in closets, attached garage, ect).

DON’T:

Blindly search Zillow for the Dream Home you can’t afford.

There’s nothing more disheartening than finding the home that checks all of your dream home boxes…and watching it turn from For Sale to Under Contract ?. While you were busy trying to figure out what to do to buy that house, someone who was already pre-approved and working with an agent beat you to it!

Try to go at it alone.

This process can be tough! Just this spring, there have been over 2,000 active buyers, each interacting with 50 listings (you can read more about the Spring 2021 Real Estate Market here)! Trying to schedule your own showings, manage expectations and understand the steps of the process can be overwhelming and discouraging – unless you have a trusted professional by your side!

Make big purchases on your credit card throughout your searching and buying process.

Keep your financials looking safe and steady! Don’t make any other big purchases when you’re trying to purchase your first home. This can cause your loan to fall through, which means you’ll lose your deal.

Be too nit-picky.

Bright red paint in the bedroom shouldn’t overshadow the fact that there is a primary attached bathroom and walk-in closet. Look past unsightly aspects of the home that can be easily improved and focus on the big picture and opportunities that the home can offer!

Pingback:สล็อต ฝากถอน True Wallet

Pingback:Arcade Game

Pingback:다시보기

Pingback:เซียน24

Pingback:superkaya88

Pingback:무료웹툰

Pingback:batmanapollo.ru

Pingback:777

Pingback:wlw.su

Pingback:vxi.su

Pingback:nlpvip.ru

Pingback:russianmanagement.com

Pingback:Slovo pacana 6 seriya

Pingback:site

Pingback:slovo-pacana-6-seriya

Pingback:manipulyation

Pingback:จดทะเบียน อย

Pingback:Update Site Error ¹ 654

Pingback:Update Site Error ¹ 655

Pingback:http://asl.nochrichten.de/adclick.php?bannerid=101&zoneid=6&source=&dest=https://devs.ng/

Pingback:354

Pingback:Link

Pingback:psy

Pingback:kiino4k.ru

Pingback:depresiya

Pingback:film

Pingback:new 2024

Pingback:batman apollo

Pingback:film2024

Pingback:123 Movies

Pingback:laloxeziya-chto-eto-prostymi-slovami.ru

Pingback:000

Pingback:samorazvitiepsi

Pingback:Tucker Carlson - Vladimir Putin - 2024-02-09 Putin interview summary, full interview.

Pingback:Tucker Carlson - Vladimir Putin

Pingback:browning auto 5

Pingback:สมัครบาคาร่า lsm99

Pingback:คอมพิวเตอร์

Pingback:ทีเด็ดฟุตบอล

Pingback:spisok

Pingback:เรียนสะกดจิต

Pingback:list

Pingback:รับเช่าพระ

Pingback:russian-federation